The tax year has started in France. Do you work in Belgium? Do you receive a Belgian pension? You have to declare it in France! You’ve come to the right place to find out more 😊

Tax border residents

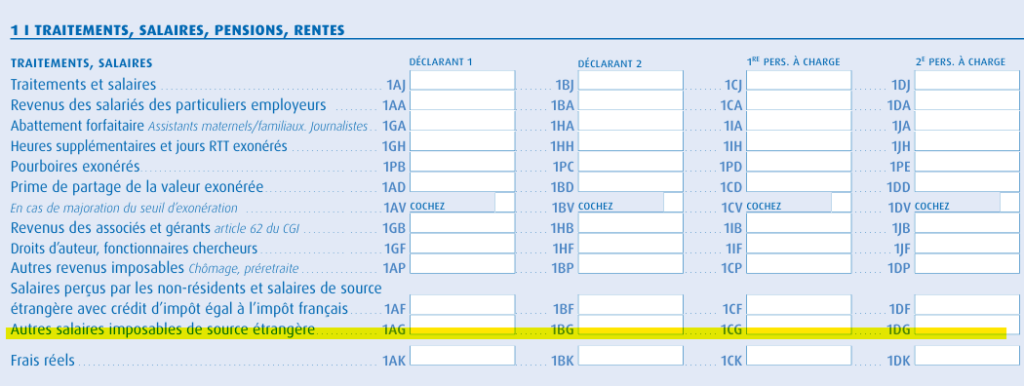

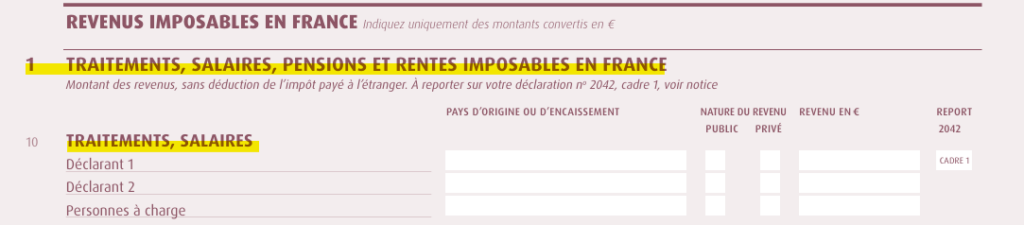

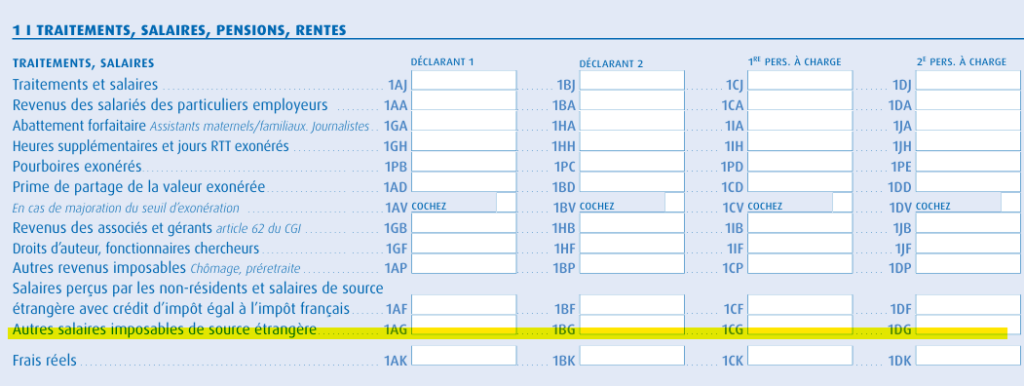

Your Belgian salaries are taxable in France and should be entered on forms 2042 and 2047, net of Belgian social security contributions. For computerised declarations, remember to use the key words highlighted in yellow!

(2042)

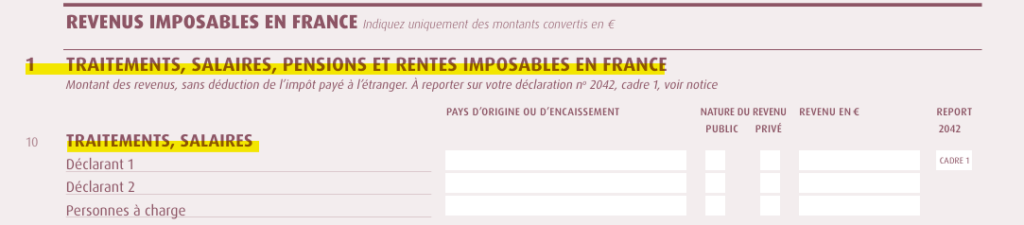

(2047)

Private sector workers (without frontier status)

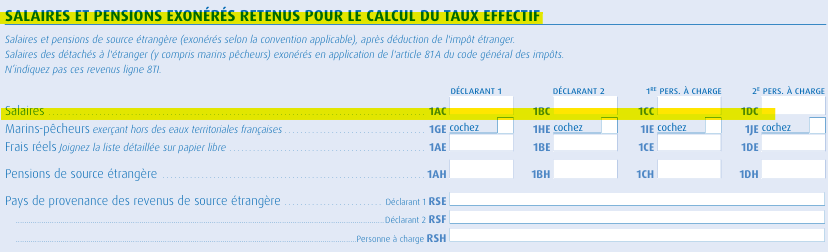

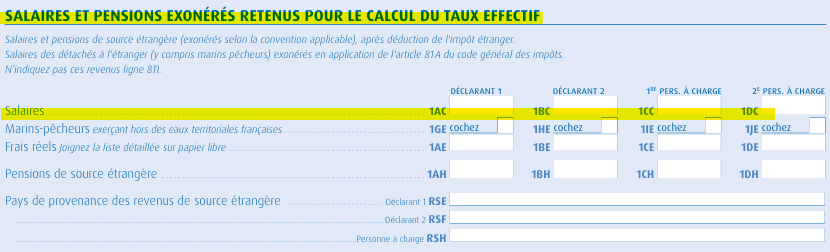

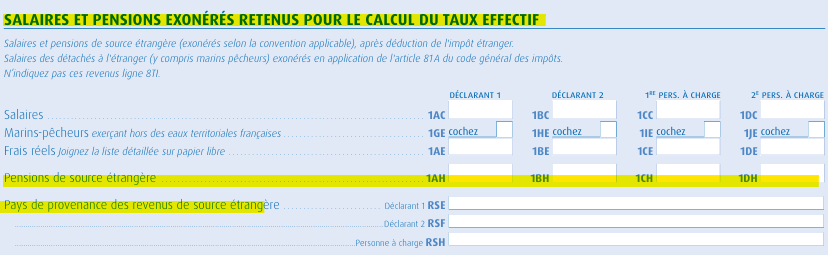

Belgian income will be taken into account when calculating the household’s average tax rate, but only French-source income will be taxed in France. Income from Belgian sources will not be taxed again. It must be declared net of social security contributions and also net of Belgian tax already paid (withholding tax).

You will need to complete form 2042C (or equivalent computerised form):

Public sector workers

If you are French-Belgian, don’t hesitate to contact us with details of your situation!

If you are of French nationality, your income is taxable in France. How do you declare it?

They must appear on the 2042 and 2047 forms, net of Belgian social security contributions. For electronic declarations, remember to use the key words highlighted in yellow!

(2042)

(2047)

If you are a Belgian national, your wages are taxable in Belgium. They must be declared net of social security contributions and also net of Belgian tax already paid (withholding tax).

You will need to complete form 2042C (or its electronic equivalent):

Retired (private sector employment)

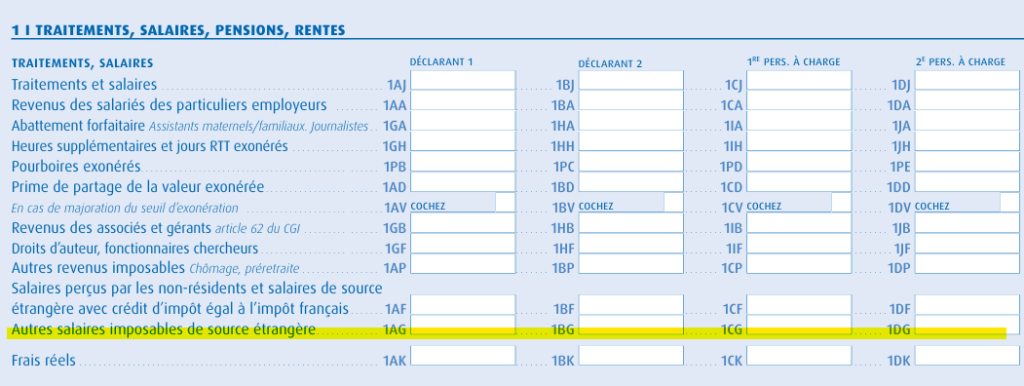

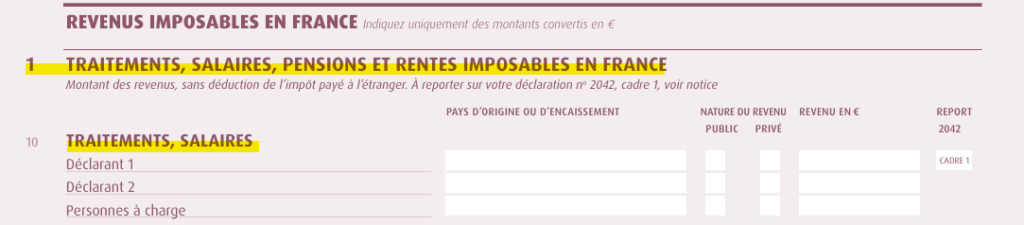

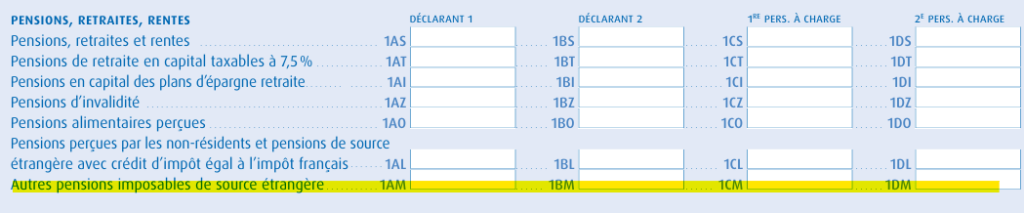

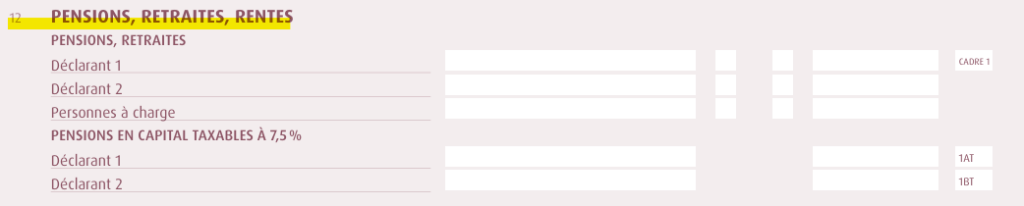

Your Belgian pension is taxable in France! It must be declared on forms 2042 and 2047.

For electronic declarations, remember to use the key words highlighted in yellow!

(2042)

(2047)

Do you receive a French pension or salary? Don’t forget to read our article on CSG-CRDS.

Retired (public sector job)

If you are French-Belgian, don’t hesitate to contact us with details of your situation!

If you are of French nationality, your pension is taxable in France. How do you declare it?

It must appear on forms 2042 and 2047. For electronic declarations, remember to use the key words highlighted in yellow!

(2042)

(2047)

If you are a Belgian national, your wages are taxable in Belgium. They must be declared net of social security contributions, but also net of Belgian tax already paid (withholding tax).

You will need to complete form 2042C (or its computerised equivalent):

Do you receive a French pension or a French salary? Don’t forget to read our article on CSG-CRDS.

Bank account in Belgium or abroad?

You must indicate this on your French tax return: https://frontaliers-grandest.eu/wp-content/uploads/2018/07/Ouvrir_compte_bancaire_etranger_2020_web.pdf

For more information, visit the website of our partner Frontaliers Grand Est